Empowering

Financial Processes.

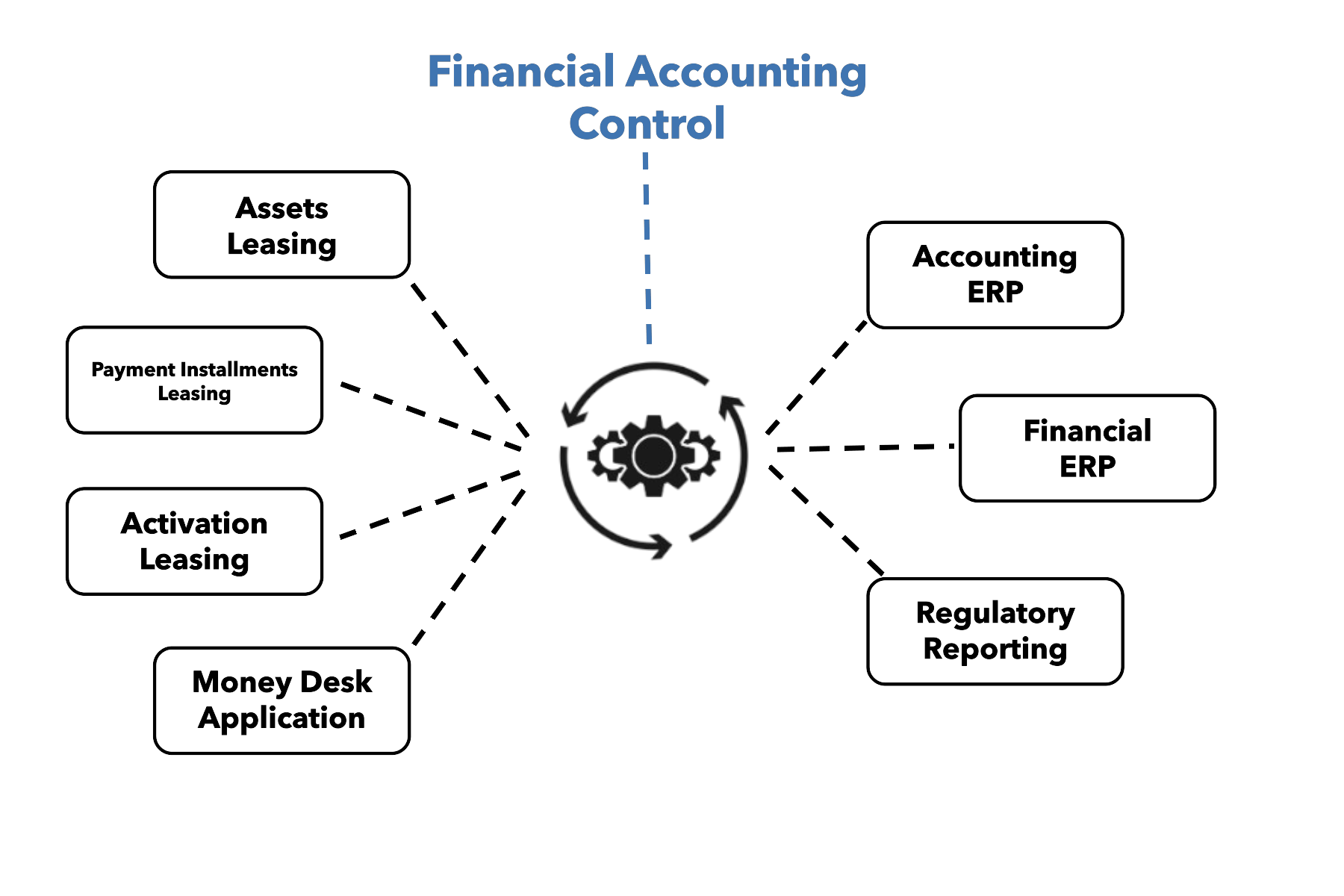

Finance Engineering, Financial Accounting and IT Integration.

SAR & TAE

EFT

SOF

BANTIQ

Base Building Blocks

for financial processes

SAR & TAE

Regulatory Adherence System

Automation of the preparation and delivery of regulatory reports: Financial Operations, Accounting, Credit Risk, Market Risk, Liquidity Risk.

- It has functional Add-ons for: Calculation of Provisions, Administration of Guarantees, Accounting for Loans in different states according to the regulator, Qualification and Typification of Clients, Control of Limits and based on Financial Statements and Operations with Clients.

- Facilitates integration with various financial systems by defining trays for capturing and processing operations and accounting.

- Certified system to operate concurrent OnCloud or OnPremise.

- Parametric and automatic generation of files to be sent to regulators.

- “Excel Like” User Interfaces suitable for accounting-financial modeling on portfolios, transactions and postings.

- Facilitate generation, preparation, deliveries through workflows and report statuses.

- Management of various time periods for correct financial accounting processing.

Get your demo

Request a personalized demonstration!

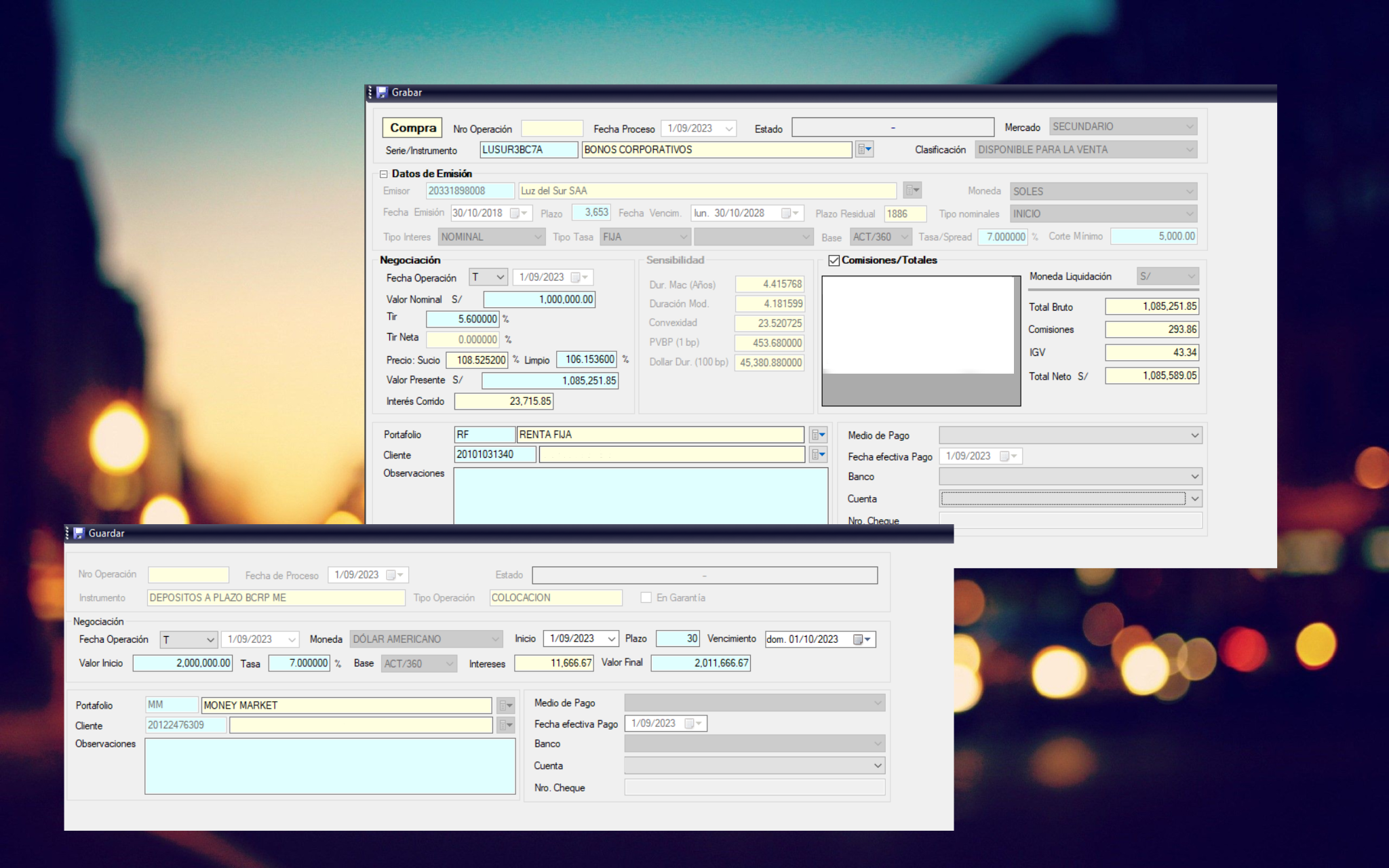

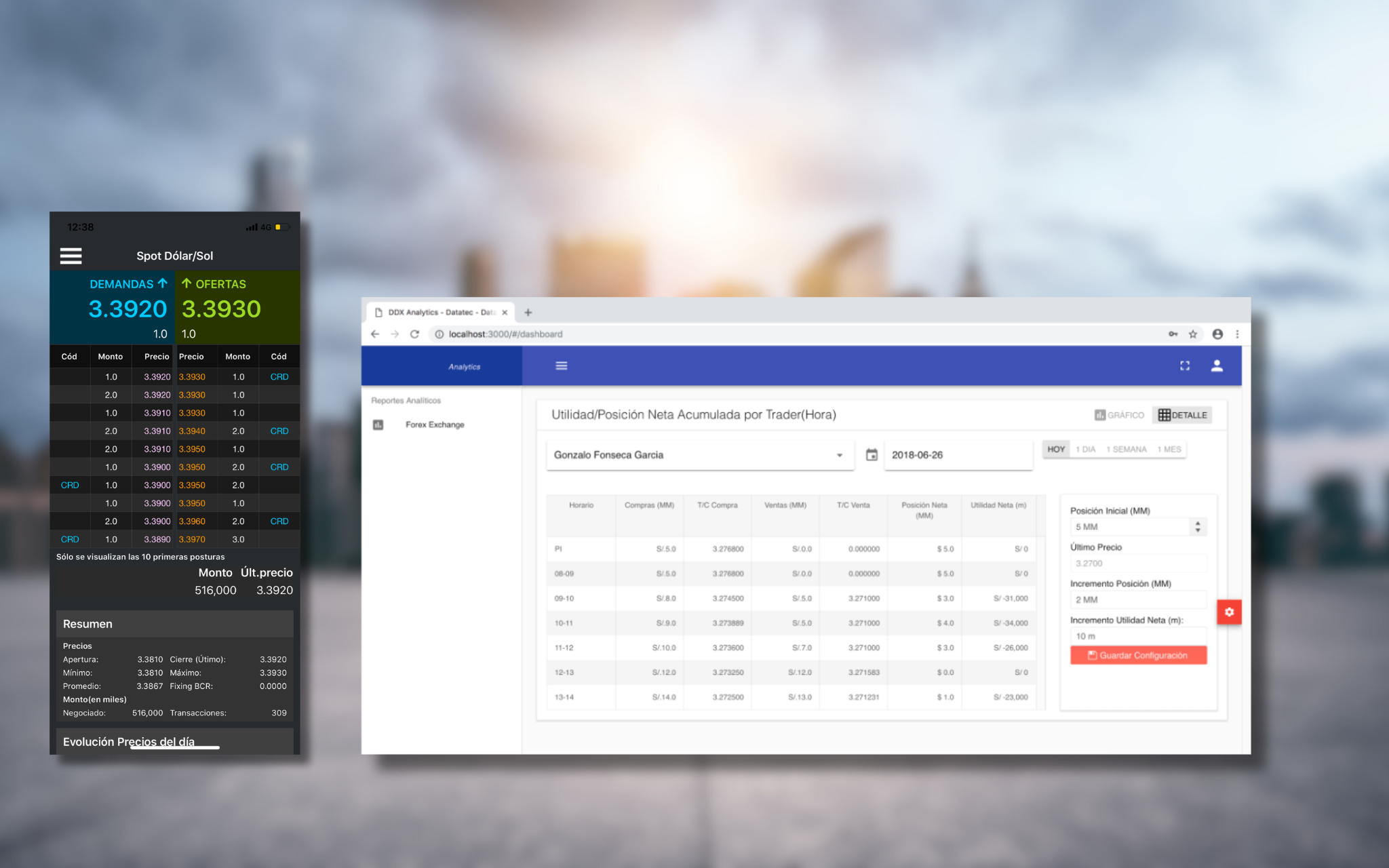

SOF

Money, Investments and Treasury Desk

Support integrated management of Investment Portfolio in Local and International Financial Instruments including: Fixed Income, Variable Income, Money Market, Foreign Exchange Operations and Instruments.

- Automatic Market Valuation.

- It has limits for risk control.

- Daily Portfolio Accrual.

- Automatic Accounting of various portfolio operations.

- Calculation of Profitability of Mutual and Private Funds

- Comprehensive Support for Participes OnBoarding

- Prepared to operate OnClod or OnPremise.

- Parametric and automatic generation of reports and files for Regulatory entities.

- Enriched User Interfaces with modeling and navigation for the execution of fast and secure financial transactions.

- Enriched User Interfaces with modeling and navigation for the execution of fast and secure financial transactions.

- Management of various time periods for correct financial accounting processing.

- Integration with Price Providers in real time.

Get your demo

Request a personalized demonstration!